North

Carolina

Business

History

North Carolina was the last of the thirteen original states to have a bank created. Perhaps, it reflected the agricultural nature of the state. But today, North Carolina banks have become national and regional leaders. Likewise, insurance companies were few until the 20th Ceturry.

Early Banking & Insurance

Early banks (click for full list) chartered by the state were the Bank of Cape Fear (1804), the Bank of New Bern (1804) and the State Bank of North Carolina (1810).

By 1860, there were 36 state-chartered banks and branches in North Carolina. Only five cities had more than one bank or branch. There were five banks and branches in Fayetteville, four banks and branches in Wilmington, three banks and branches in New Bern and two banks and branches each in Charlotte, Greensboro and Raleigh. The other 18 banks and branches were located in such towns as: Salisbury, Morganton, etc.

Prior to the Civil War, there were at least 9 North Carolina insurance companies selling fire, marine and life insurance. In addition, there were numerous antebellum insurance agents representing insurance companies in the state, the South and the North.

Attempts to form insurers began as early as 1794, although the first successful North Carolina insurer was apparently the North Carolina Mutual Insurance Company (selling fire insurance) started in Raleigh in 1847. There were insurers in Raleigh, Greensborough, Fayetteville, Milton, Salem, Elizabeth City and Goldsborough.

During the Civil War, many banks were closed and the remainder faced bankruptcy immediately after the conflict with the canceling of state war debt. Insurance companies also faced financial catastrophe due to destruction and an economic depression during the war. Just a few insurers survived the war years.

1865 - 1900

Following the Civil War, new banks were launched with federal and state charters. Federally chartered banks at the time could not make loans with land as the security, plus limits on loans to any one person posed a significant impediment to those harvesting and marketing cotton and tobacco, which required large funds at certain seasons.

Banks often were created as an adjunct to a new bright leaf tobacco market being launched — for example in Smithfield (the Bank of Smithfield) — or area textile industrialization, such as in Charlotte and surrounding counties.

Periodic financial panics — today labeled deep recessions or depressions — hit the economy from the 1870s through the 1930s. Surviving banks were generally those most conservatively run and invested.

By the last decade of the 19th century, renewed financial capabilities saw the establishment of several North Carolina insurers that would prosper into the 21st century.

20th Century

In the early part of the 20th Century, the state’s economic development was reflected by a 209% jump over a decade in bank assets, while the increase was only 101% in the rest of the country. “These comparative figures have a double significance,” noted Professor C. T. Muchison. “In the first place they are a tribute to the competency and enterprise of the state’s banks ...in the second place, they stand as ... evidence of the amazing growth of the state’s economic activities” such as textiles, furniture, tobacco and other business developments. Muchison went on to day: “in this spectacular economic growth, the state’s banks have been a leading force.”

There was substantial development of life, as well as property & casualty companies, at the turn of the 1900s in both Greensboro and Raleigh.

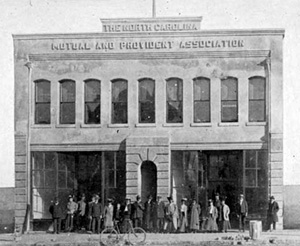

The Jefferson-Pilot companies were formed just after the turn of the century, while the successful Durham's North Carolina Mutual and

Provident

Association

(renamed in 1919 as the North Carolina Mutual Life Insurance Company) was

created in 1898 and launched in 1899. This firm was owned and operated by African-Americans, especially

Dr. Aaron M. Moore,

John Merrick,and C.C. Spaulding (shown at far right photo, left to

right order). One of the insurer's early leaders

(1933 - 1968) was NC Business Hall of Fame Laureate Asa

Spaulding, a nephew of

C.C. Spaulding and often acknowledged as the country's first black actuary.

Provident

Association

(renamed in 1919 as the North Carolina Mutual Life Insurance Company) was

created in 1898 and launched in 1899. This firm was owned and operated by African-Americans, especially

Dr. Aaron M. Moore,

John Merrick,and C.C. Spaulding (shown at far right photo, left to

right order). One of the insurer's early leaders

(1933 - 1968) was NC Business Hall of Fame Laureate Asa

Spaulding, a nephew of

C.C. Spaulding and often acknowledged as the country's first black actuary.With the creation of interstate banking in the 1980s, North Carolina banks began expanding, often picking up banking operations in trouble in other states. Today, Charlotte is the second largest banking center in the U.S., following only New York.

Nationally ranked by assets, Bank of America, Wachovia, BB&T and First Citizens Bancshares are just some of the NC-based banks that make this state a national financial center. They are joined by other industry pacesetters, such as The Bank of Granite and Central Carolina Bank.

This growth in the 20th Century was led by such executives as Thomas Storrs, Addison Reese, Helen Powers, George Watts Hill Sr., L. Vincent Lowe Jr., Hugh McColl, Cliff Cameron, Ed Crutchfield, Archie Davis, John Watlington Jr., John Medlin, Hector MacLean, John Forlines and Lewis Holding.

NC Historical Facts

Insurance

companies <1900

Insurance agents <1865

Typical North Carolina main bank

teller station in small towns (circa

1935).

Industries Laureates Contact

Us Home

2005 Copyright. CommunicationSolutions/ISI

for web site and content.